Note: Substack says this is too long for email. Please read in the App or a browser

OK I am aware that I’m definitely following a trend here to write about tariffs, but since I recently wrote about national wealth1 I think I’m allowed talk about tariffs since they will likely affect national wealth.

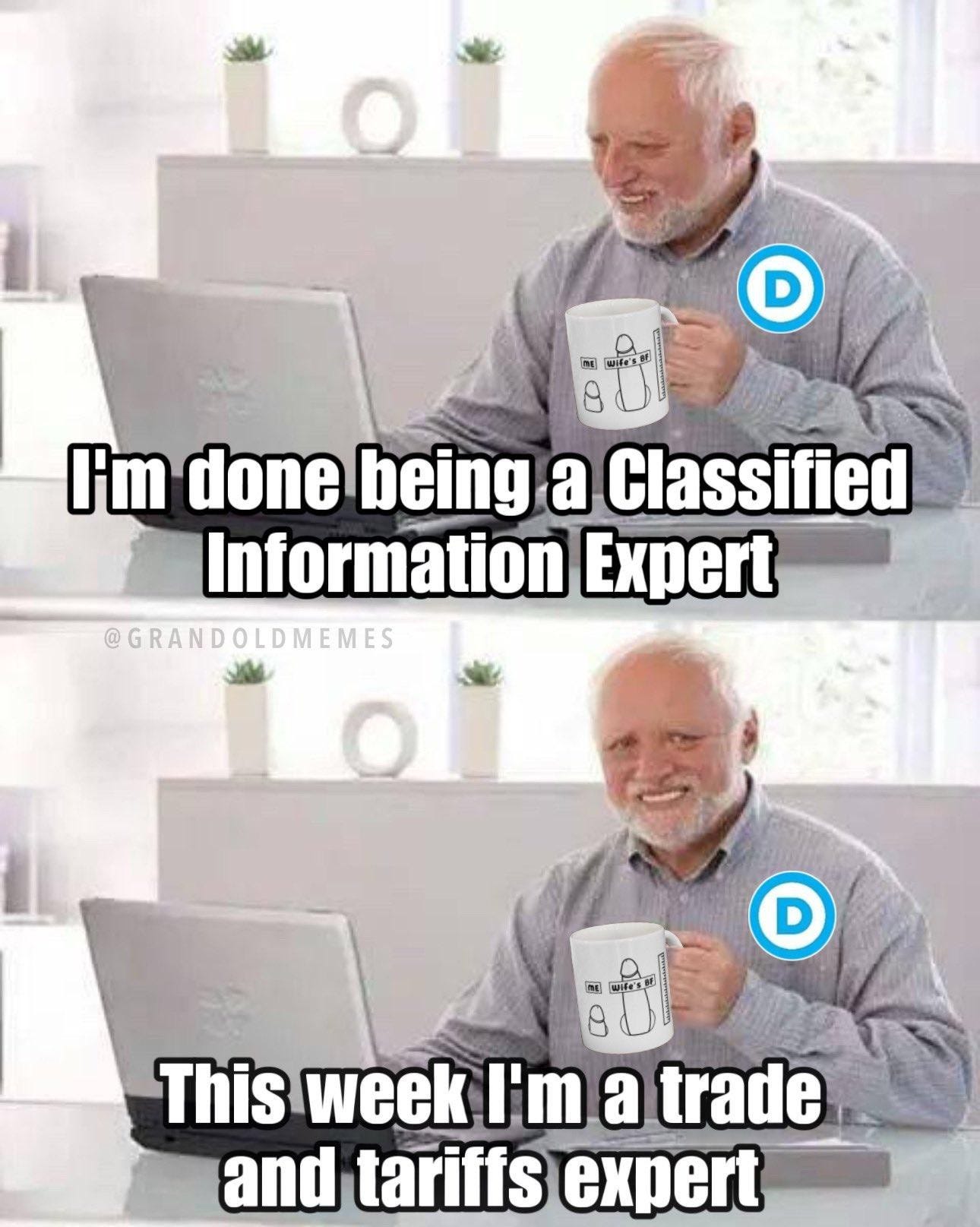

One small observation is that people (and stock markets) seem to be acting surprised that President Trump imposed tariffs. These people have shown themselves to be idiots as this article notes. Tariffs were something he talked about during the election campaign and he also briefly wielded them to get certain nations to comply with his demands regarding immigration and so on. So, given that, and given that he has already implemented a bunch of his other campaign promises, there is no excuse for being surprised that he implemented tariffs.

The Goal of Trump’s Tariffs

Since there are (see above) lots of idiots who (claim they) don’t understand why Trump is imposing tariffs let me explain in a few words. Part of “Make America Great Again” is “Make America Make Things Again” and that means having factories in America producing goods for Americans to buy. Tariffs are an incentive for companies to build factories in America instead of offshoring them and importing their output.

Part of “Make America Great Again” is “Make America Make Things Again” and that means having factories in America producing goods for Americans to buy.

Peter Grant has more on this:

Basically, tariffs benefit those who produce locally. Goods made in America are not subject to tariffs, and the components and elements used in their manufacture are not subject to tariffs if they're also locally produced. Imported components and elements are subject to tariffs, but since they're typically a fraction of the cost of the finished article, the tariffs don't add too much to the cost of the article.

Tariffs do not benefit - indeed, they indirectly attack - those who want to "export" manufacturing and production to cheaper environments offshore. The primary reason so many jobs were lost in the USA over the past few decades is not just technological advancement: it's also that wages and associated costs overseas were a small fraction of US levels. (That's no longer as true as it was, because overseas wages and costs have increased dramatically: they're still usually lower than ours, but not by nearly as much as they were.)

Thus, the rise of "globalism" was, in fact, a push to send expensive manufacturing overseas rather than keep it here. Why? Because companies could make much more money by producing their products at a low cost, importing them at minimal or no tariffs, and then selling them for as much as they'd charge for US-made products. Alternatively, they could make their low-cost products and sell them more cheaply than their US-based competitors, thus cornering the market and driving the others out of business.

There’s more in his article about how Wall St incentives drove manufacturing companies to become basically credit companies with a side business making things for the company to make loans for people to buy that is worth reading but isn’t, I think, as important.

Anyway that’s the goal. Make America Make Things Not Import Things

Are the tariffs imposed correctly?

Maybe, maybe not. I am aware that quoting from National Review about Trump is prone to error, but this summary from NR seems consistent with what I’ve read elsewhere:

When the Trump administration said it would calculate “reciprocal” tariff rates for every country according to an undefined assortment of “trade barriers” (some of which, such as value-added taxes, are not actually trade barriers), it was creating for itself a nearly impossible task. After two months of complete confusion, it settled on one of the worst possible methods to set tariff rates: It divided the country’s goods-trade deficit with the U.S. by its amount of exports to the U.S. and then divided that in half. For the more than 100 countries with which the U.S. has a trade surplus, it set the tax rate at 10 percent. It’s all based not on tariffs or unfair trade practices but simply on the existence of a trade deficit, and on the dogged belief that trade deficits are bad.

The NR note goes on to point out (also AFAICT correctly) that this imposes tariffs on (some) US allies that are higher than the tariffs on (some) US enemies and that the claim that it is “reciprocal” is rubbish since it applies tariffs to countries that do not impose tariffs on imports from the US to them. That is actually potentially problematic and counter productive since those low tariff nations are now incentivized to export to places other than the US. But…

Remember that Trump is a businessman. Businessmen often make an initial offer that is not what they expect to settle for.

In particular I expect these nations to do something simple like pick up the phone and ask the White House what they can do to reduce the tariffs and I predict the answer is going to be import more stuff from the US. Many countries that have got higher tariffs than expected are ones that have imposed quotas to limit the total amounts of certain goods that can be imported (from the US). Removing some of those quotas will likely see the tariffs reduced. Israel is a good example of a country that, despite having zero tariffs, still makes imports hard.

Japan and Korea also come to mind in this regard. Also importing (say) American oil and gas instead of getting it from somewhere else will probably help. Probably there are other things, like buying more US made weapons that will help or promising to invest in more factories in the US.

In fact, over the weekend countries have indeed started to pick up the phone. The likely result is that in a couple of weeks the tariffs on some places will be reduced. The other likely result is that there will be carve-outs and exceptions for specific categories of goods from specific nations. Right now in most cases everything from a country is subject to the same tariff whether it’s raw ore or finished product. In fact we’ve already seen that with the clarification that some vehicle stuff made in Canada and Mexico is not subject to the regular tariffs for products from those countries. I expect this to increase as Trump gets feedback from business leaders about what the costs of certain supplies means to the cost of the final product and to the likely shutting of factories.

Of course some other countries (the E.U., West Taiwan…) will likely impose retaliatory tariffs on US goods and we’ll get to see how badly that puts the brakes on global trade and also how it impacts prices in the USA. Trump, we note, doesn’t actually care about prices or the economy in general outside the US, so people saying this will cause havoc in West Taiwan or Europe are not making a winning argument.

Second Order Effects

The price of oil is falling. It is some 10% lower than it was a week ago. That’s going to help offset the price increases caused by tariffs. Both directly, in that drivers will pay less at the pumps, and indirectly, because cheaper fuel helps reduce the costs of goods for sale by reducing the cost of distribution2. [Update: it also puts Russia and Putin in a tougher position because oil is Russia’s main way of funding its war]

Second as noted in various places including the prophetic 4chan post screenshot below, US interest rates are falling because of bond yields.

That, coincidentally (ya think?), means that the interest rate the federal government has to pay on it’s enormous debt decreases which, in turn, reduces the deficit and extends the time needed for Trump and the Republicans in congress to get their ducks in a row and pass an actual budget - something that they appear to have nearly done. As noted here3, the tax cuts seem likely to massively help the small business owners and employees who are a) Trump’s core supporters and b) the engine of economic growth in the US anyway:

Stingy corporate media will never give the President credit, but the tax cuts could fairly be called historic. They include a permanent extension of his 2017 plan, which lowers the top individual tax rate (from 39% to 37%), increases the ‘standard exemption,’ doubles the child care credit, and provides a 20% exemption for pass-through business income.

That last one —the 20% exemption for pass-through income— helps small businesses, freelancers, and gig workers like Uber drivers. Not big corporations.

And that’s just the start. New tax cuts will be wildly popular: no tax on tips, no tax on overtime, no tax on Social Security benefits, and a lower corporate income tax for American manufacturers (falling from 21% to 15%).

If passed by the House, the package would lock in a low-tax regime for a generation, a shift not seen since Reagan’s era. Even a pared-down version would rank among the biggest tax relief efforts ever, measured by dollar value.

The combination of second order effects - lower interest rates, lower taxes, lower oil prices - are likely to, partially if not completely, counteract the price rises that will be seen by tariffs on imports.

So will they work?

I would be remiss if I didn’t mention a few substacks I follow who are negative. So here are Noah Smith, Thomas Gregg and Arnold Kling giving various degrees of negative view. The argument made by the anti-tariff lot is twofold.

First protectionism and self-sufficiency leads to protected bloated national champions that produce crappy goods at inflated prices due to lack of competition. Brazil and other Latin American countries may be mentioned, also (see subtack linked above) Israel. And then of course there’s that well-known self sufficient sucess story - the Democratic People’s Republic of Korea.

Second they say that even if the US can become more self-sufficient it will take time to build the factories and train the workers etc. and that the sharp increase in prices now will cause a recession. The recession together with the stock market crash will mean there’s no funding available for the new factories required to build the stuff that was being imported. So therefore factories won’t be built and everyone will be poorer for the lack of Chinesium in their diet.

The protectionism argument is a poor one. The Trump goal, as I understand it, is a 10% tariff for all imports. 10% is enough to provide a small cushion for temporary inefficiency but not enough to sustain the sorts of large, long term price differences that block innovation and lead to bloat. Very little of what the US imports from places that are likely to remain highly tariffed (i.e. West Taiwan) is solely available from there and so what we may see is that other countries step up to produce the cheap plastic stuff that the Chinese mostly export to the US. The other thing to note here is that 5 years ago, during the Covidiocy, Chinese exports dropped significantly and the US managed just fine. Yes we all complained about “supply chain” and shortages but that’s actually an argument for local production not an argument against it because local production means shorter supply chains.

The lack of “shovel-ready” plans for factories and a lack of trained workers is probably more valid. But not that much. Much of the delay in building stuff is getting the relevant government permission slips to do so. Environmental impact studies, zoning regulations / permits and other similar regulatory requirements are the bit that takes the most time. I think it is fair to say that under Trump federal regulatory requirements for new construction are going to be massively simplified. Will it be zero? no. And that’s generally good because, while agencies like the EPA definitely suffered from mission creep, pouring acid into rivers and creating toxic clouds of smoke are not things we want - even when the EPA does it themselves. So a streamlined EPA that looks at the plans and rejects ones that lack retaining dams or filters is a good thing. On the other hand there’s a difference between polluting a riverway and causing the possible death of a population of lesser spotted snail darters due to loss of habitat. There’s no doubt in my mind that under Trump worries about the habitat loss of lesser spotted snail darters and the like are not going to be allowed to stop development.

So that means its going to be up to the states. Some states (e.g. Texas, Florida and states in between them) are going to have similarly light regulatory touches that ask relevant questions (e.g. is it a fire hazard? will it blow away in a hurricane?) and assuming the architects/engineers/builders show that it meets those requirements will issue the relevant permits. Other states (you know which ones) will insist that even reuse of existing building space requires environmental impact studies, mandatory public comment periods, diversity quotas and so on. That means the trends of US economic growth and population growth being mostly in the “red” states are going to continue and may in fact pick up speed.

Now will that be enough? Maybe. John Ringo points out that the new industries that come back are going to be heavily automated. Three-D printing, robotics, CNC and so on are going to be basic table stakes. We are not going to see the industry of the mid 20th century with dozens of workers doing the same repetitive tasks. That implies that finding qualified workers could be a challenge, but on the other hand not every worker will need a BSc in computer science, there will still be a need for forklift truck operators, wrench turners and so on. And it turns out there are plenty of mostly qualified people doing fairly low paying technical jobs like web design, ad tech and so on that can be enticed to new jobs that pay more.

Some of this is going to take time, but economics is all about the margins. Make some things easier and some more people do/buy etc. them as opposed to things that are harder. Thomas Gregg in the link above has the following (classic) economics story:

Assume that a fifty percent tariff is imposed on all imports of foreign wine. Suddenly, American devotees of French reds and German whites find themselves paying significantly higher prices for their favorites. But that’s fine, say Trump & Co. Those consumers can purchase American wines instead. Demand for American wine therefore increases. But due to the constraints imposed by viniculture, the supply of quality American wine cannot be instantly increased. Indeed, it will take years to ramp up production. So the price of American wine will shoot up, or its quality will decline significantly, or both.

This is wrong in multiple ways. First not all foreign wines are tariffed equally. EU wines are (say) 50% while Argentinian wines are 10%. The tariffs will hurt the (relatively) few wine snobs who insist that they drink vintage Chateau Lafite (or whatever), as they either drink less or bite the bullet and go for some Napa valley snob wine instead. But most wine drinkers are not wine snobs, they want a reasonable wine that goes with the food or the mood and they don’t really care if it comes from France, California, Virginia, Argentina or New Zealand. The wines I’m talking about are the “two buck chuck” ones and a grade or two up. They have named grapes, known styles, and quality control. If they have a terroir it is an area the size of Belgium and the wines are designed to taste the same year after year. If French or New Zealand Chardonnay now costs $15 and Chilean ones cost $10 they’ll switch. If their California brand goes up market to handle the wine snobs they’ll switch to Argentina and so on.

And for people who want to be snobby about their drink, there are plenty of ways to do that with drinks other than wine. America makes lots of different whiskies, gins and other distilled spirits. Not to mention craft beers (which again can be more than the mega hopped 150IBU Imperial Triple IPA San Diego monstrosity), meads, ciders and so on. Who knows, if the tariffs work, maybe Japan can export some of its excellent craft sakes (and I’ll be ecstatic to give guidance on terms like kimoto, nigori and so on, so that wine snobs can become sake snobs). And if that takes off, maybe California can start making its own craft sake.

It will however require some American businesses to think slightly out of the box. For example Ars Technica has a story about board game makers who miss their cheap suppliers in West Taiwan. Board game tokens are almost ideal for 3-D printing so maybe the solution is buy a few 3D printing kits and allow buyers to customize some of their tokens for a few dollars more? Maybe they can find an injection molding company in Vietnam? or India? if they can’t set one up in Indiana. And so on.

Yes imposing tariffs is disruptive. It’s meant to be. That doesn’t mean it can’t be adapted to. People and businesses adapted to the covidiocy. They can adapt to this. In fact it is quite possible that this disruption is going to be a sieve that weeds out the businesses and management teams that can’t adapt and I’m fine with that. To go back to the Peter Grant link near the top, the financialization of everything to get stock market growth has had many negative consequences, changing back to forcing a focus on product and service can only be good, even if it results in a large number of MBAs losing their jobs.

Fundamentally I think the overall concept is fine, the nitty gritty details are probably adjustable so they work out OK, and the US, as a whole, is big enough to adjust without falling into an actual recession, especially given the tax changes that appear to be about to happen. A technical one caused by GDP contraction that is due to reductions in government spending etc. may occur but even that may be avoided. After all, despite significant job losses in the Federal Government and related sectors, overall hiring was up significantly last month. No reason the same should not happen to GDP

Update: I should add that this substack comparing the US to a company that Trump 2.0 is putting through a (pre) bankruptcy workout to make a lot of sense, and gibes with much of what I wrote above.

What is the Wealth of a Nation?

I’ve been pondering the problems with GDP statistics for a while now. Economists love them, and they do give an idea of how wealthy a nation is, but rather like the accursed BMI of obesity studies, they are also highly misleading. In fact, just as BMI was useful on a population level when it wasn’t being closely monitored, much the same applies to GDP. …

One of the things the Japanese government did for the last few years is diddle with the taxes etc. on gasoline so that the price at the pump remained fairly stable even as the yen sank in value. I suspect that was probably one of the better government interventions in the market because it allowed Japanese logistics to keep running at the same level and price all the time as well as reducing inflation and cost of living increases for all residents of Japan

Thank you for this. Gives me more ammo in my fights against the tariff naysayers. I find that the stat on how few Americans own that much stock especially important. Yes, taking money from the few rich and spreading it out throughout the land is something that needs to be done. Shocking to hear myself think this but is not a situation where their financial success is due to these few outperforming the rest of us.

Read earlier today that more than 50 countries have called to ask for negotiations on the tariffs. I think this bolsters your thinking that the tariffs are just his opening bid, as it were.

As I've stated elsewhere, I don't know if Trump's tactics will work for his goals - stated or otherwise. But I have seen him turn "conventional wisdom" by "the experts" into confetti so many times now that I'm willing to give him a long leash on this. And given his rising popularity in the polls, a bunch of other people apparently are too.