Judge Talks, Money Walks

39 words that mean New York may be entering the "suddenly" phase of its collapse

Along with many others I noted the NY verdict in the Trump “Fraud” case where, despite absolutely no one claiming any harm whatsoever, the judge decided to fine OrangeManBad $355M plus interest. There’s an interesting comment here about how this should not be classed as criminal fraud:

This is the definition I found that applies to ALL cases no matter how the elements are worded is this: FRAUD IS THE VOLUNTARY TRANSFER OF SOMETHING OF VALUE BY DECEIT. The occurrence sued on and alleged to be fraud MUST be (1) VOLUNTARY, (2) A TRANSFER, (3) OF SOMETHING OF VALUE, (4) BY DECEIT. If any of these four elements are missing, it’s not fraud. Obviously, New York is missing the transfer element which, I think, makes each of the other elements a non sequitur and meaningless.

All of us who are not currently suffering from TDS could see that the whole thing was a put up. Kevin O’Leary explained the whole thing well a few weeks back.

https://twitter.com/charliekirk11/status/1745847252617494997

Even the AP, that well known haven of Right Wing MAGA Christo-fascism (sarc), noted that the statutes used had never been used before to prosecute a case where there were no victims.

An Associated Press analysis of nearly 70 years of civil cases under the law showed that such a penalty has only been imposed a dozen previous times, and Trump’s case stands apart in a significant way: It’s the only big business found that was threatened with a shutdown without a showing of obvious victims and major losses.

[…]And though the bank offered Trump lower interest rates because he had agreed to personally guarantee the loans with his own money, it’s not clear how much better the rates were because of the inflated figures. The bank never complained, and it’s unclear how much it lost, if anything. Bank officials called to testify couldn’t say for sure if Trump’s personal statement of worth had any impact on the rates.

“This sets a horrible precedent,” said Adam Leitman Bailey, a New York real estate lawyer who once successfully sued a Trump condo building for misrepresenting sales to lure buyers.

Added University of Michigan law professor William Thomas, “Who suffered here? We haven’t seen a long list of victims.”

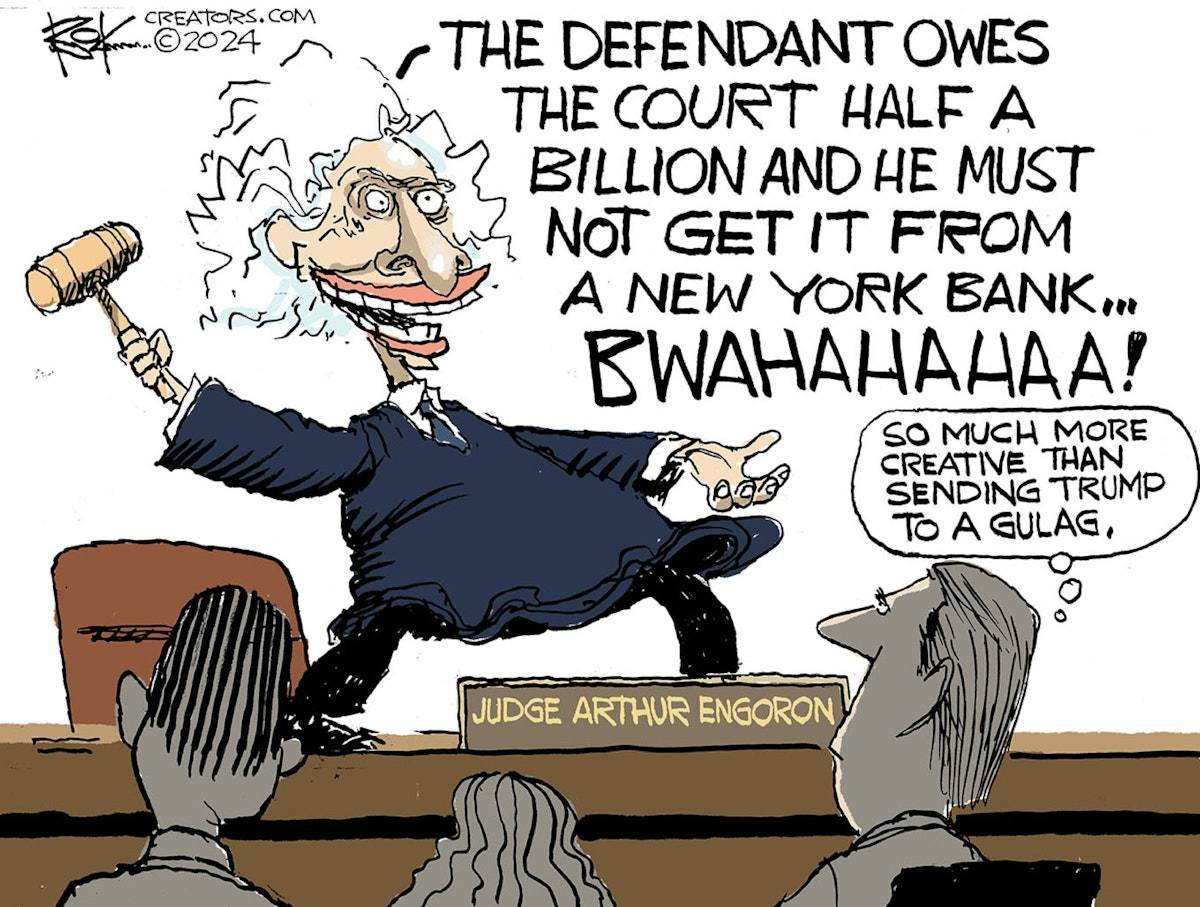

Well the Judge clearly felt otherwise and while he didn’t force the entire Trump operation to cease doing business, he did stick it with this enormous fine. Moreover, as Mark Steyn points out, he seems to have intentionally made it hard for Trump to get a loan to stump up a bond while he appeals the case:

The Court hereby enjoins Donald Trump and the Trump Organization and its affiliates from applying for loans from any financial institution chartered by or registered with the New York Department of Financial Services for a period of three years.

This, ladies and gentlemen and small furry creatures from Alpha Centauri, is 39 words that will likely cause the mass exodus of financial firms from Wall St. And it won’t be just that the offices are vacant.

Other commentators, such as Jonathan Turley and Martin Armstrong, have concentrated on the enormous fine and that is certainly an issue. But I think those 39 words are likely to be more important.

The judge has declared that, despite no victims coming forward, a New York business may not enter into a contract with any New York financial institution when otherwise both parties would be willing to sign an agreement. That means that, potentially, any other New York business, such as a hedge fund or an investment fund in real estate, mines or pretty much anything, that ends up in the crosshairs of an activist DA could be banned from borrowing from any financial institution that has a NY presence. Moreover the judge has made clear that the judiciary will not necessarily stop an activist DA’s lawfare but may in fact jump in and help.

Despite Gov Hochul and others saying “honest this only applies to OrangeManBad”, investors and others are well aware that a precedent has been set and that while it may be only “OrangeManBad” in 2024, by 2026 or 2028 it could be anyone who, say, does business with Israel or invests in Texas or who fails to employ a Director of Genderqueerness or some other arbitrary practice.

The first thing to note here is that this will not actually stop Trump from getting a loan if he wants one. He’ll find someone in Florida, or the Bahamas or Japan to lend him the money and they, in turn, may well talk to a bank and get the money. Quite likely that bank will be “chartered by or registered with the New York Department of Financial Services” and Trump will end up paying some small %age more for his loan to pay off the middleman. However banks don’t like it when middlemen get involved and they also don’t like it when they see a large loan being made by competitors that they are unable to compete with because of some annoying judicial ruling.

Second New York’s real estate market is not booming. A quick search gets you articles like this:

New York City-based developer Vornado Realty Trust is considering using a plot of land near Madison Square Garden and the Empire State Building to house a 150-foot tall billboard, among other options.

And the Epoch Times reports that various real estate investors have decided to avoid New York. So does Martin Armstrong in the link above.

Third, apart from tradition, there is very little that requires businesses to have a New York location and thanks to 9/11 plenty of key trading etc. infrastructure has moved out of New York City and in many cases out of the state as well (Hi New Jersey).

Put this together and what you have is an opportunity for a state like Texas or Florida to attract most of Wall Street to move. The regulatory climate will be better, the actual climate is warmer but not in general worse thanks to Air Conditioning, property prices are generally lower and personal tax rates are way lower. About the only reason to stay close to New York is to communicate with the SEC, the Fed and other regulatory agencies.

I have no idea how many large US / global banks or other financial institutions feel they are required to have presence in New York (as opposed to some other part of the USA). My guess is that quite a few boards are asking their legal departments and compliance departments what happens if they move the HQ out of New York and demote the New York office to a minor subsidiary. That subsidiary may even end up being a legally separate entity that simply acts as a reseller in New York in order to ensure that the parent company cannot be compelled under laws like the ones used to get Trump.

If enough such organizations discover that they have no need to be in New York then they’ll all debunk which means that a few hundred thousand well paid jobs will leave the state along with all the corporate taxes of the companies that employ them.

That exodus is going to make California’s exodus look like a trickle. And it will all because the state as a whole decided to go after OrangeManBad

We moved to North Carolina 5 years ago. I was born in Queens, raised on Long Island, and lived and raised a family in Westchester for over 40 years. When asked "What brings y'all to Charlotte?" my first response has always been (and will continue to be) "Andrew Cuomo"...

Every factory worker creates nine jobs.

Every trader on Wall Street creates 128.

That's not a typo. 128 jobs are created by every trader. Similar or higher when you're talking about IB. (Which is what this is about.)

When those high paying bank jobs go elsewhere...

NYC has long been the 'one stop shop' for money. If it stops being that... It really doesn't have another use.